fleet and driver compliance solutions

WE KEEP YOU MOVING

Facilitating the growth and prosperity of the trucking industry.

fleet compliance services

vehicle compliance

Vehicle Titling, Registration, and Permitting for Motor Carriers (private or for-hire): To legally operate a Motor Carrier in the U.S., you must comply with titling, registration, and permitting requirements at the federal and state levels.

DRIVER COMPLIANCE

Driver compliance with the Federal Motor Carrier Safety Administration (FMCSA) is essential for maintaining the safety of both commercial motor vehicle (CMV) drivers and the public. Here are the key compliance areas: Driver Qualification Requirements; Drug and Alcohol Testing Compliance.

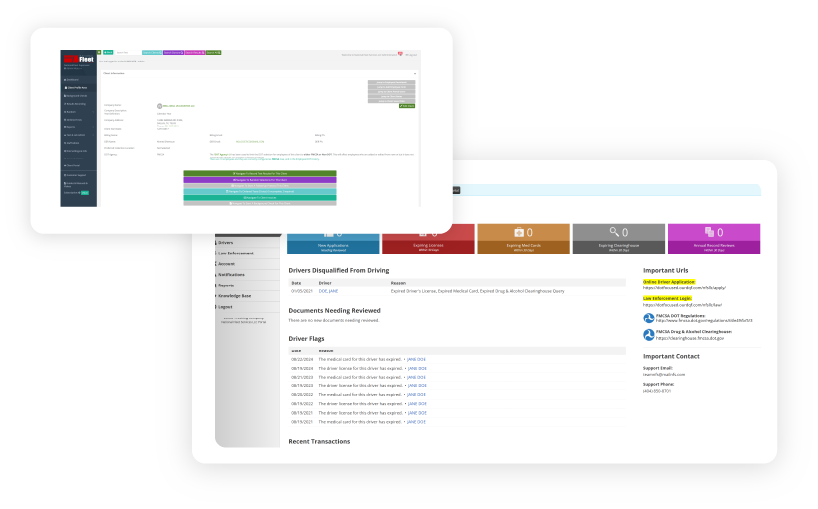

DOTFocused software

National Fleet Services DOTFocus software specializes in providing online Department of Transportation (DOT) Driver Qualification (DQ) software, designed to streamline and automate the compliance process for commercial carriers and CDL drivers.

Key Features of DOTFocused Software:

- Online Driver Application: Prospective drivers can complete DOT-compliant employment applications through an online portal, simplifying the hiring process.

- DOT PSP and State MVR Reports: The software integrates directly with DOT systems to provide instant Pre-Employment Screening Program (PSP) reports and State Motor Vehicle Reports (MVRs), aiding in thorough background checks.

- Automated Compliance Tracking: The system monitors critical dates such as driver's license and medical card expirations, and automates annual reviews, ensuring ongoing compliance with DOT regulations.

- Electronic Documentation: All necessary forms are available electronically, allowing for online completion and electronic signatures, reducing paperwork and administrative burden.

- Multilingual Interface: The platform supports both English and Spanish, making it accessible to a diverse user base.

DOTFocused is Simple & Easy to use Across all Devices

Stop wasting time and money using old fashioned paper filing systems rife with human error.

You'll be en route to success

National Fleet Services LLC is committed to providing motor carriers a lower cost alternative service offering for the essential “in-house” compliance requirements. We are devoted to “giving back” to the continued health and future growth of the trucking industry, and in doing so, helping to ensure future opportunities for motor carriers to grow and prosper.

Any questions? We Have Answers

I want to open a new trucking company, what do I need?

- Register your business and trademark the name

- File for an EIN with IRS

- Obtain a USDOT number & Authority

- Obtain a BOC-3 Agent & Insurance

- Obtain an IRP and IFTA account

How much does it cost to get your own trucking authority?

The FMCSA charges $699 to file the paperwork and get your authority issued.

What is a BOC-3 processing agent?

It’s an FMCSA agent or business that receives legal documents on behalf of a company. This includes court papers, complaints, and summons. Our related company 1+49 Process Agents LLC provides agents in all 50 states.

What is UCR?

It’s an annual fee that all individuals or companies that operate commercial motor vehicles across state or international lines must pay based on the number of vehicles.

What is biennial?

It’s an update with the FMCSA that requires entities to update their information every two years.

What is IFTA?

It's a fuel tax collection and sharing agreement for the redistribution of fuel taxes paid by interstate commercial carriers.

What is HVUT?

The heavy vehicle use tax or HVUT is a fee assessed annually on heavy vehicles operating on public highways at registered gross weights equal to or exceeding 55,000 pounds.

I bought a truck; how can I get it registered and get my plates?

You will need to title the vehicle first with your local county and then add it to your IRP account.

I am running under somebody else’s authority; can I open an IRP account?

Yes, as long as you have an Employment Agreement.

How does your drug & alcohol consortium work?

We send drivers for a pre-employment test and once negative results are received, we will add the driver into our drug pool. Testing is conducted at a designated site across the US.

I’m the owner, but I don’t drive why do I have to be enrolled in a consortium?

As an owner-operator of a commercial vehicle, even if you don't personally drive, you are still required to be enrolled in a consortium because DOT regulations prohibit single owner-operators from managing their own random drug and alcohol testing program.

I am enrolled in your consortium, but I have not been tested randomly, why?

If you are enrolled in a drug testing consortium but haven't been randomly tested, it's likely because random selection is based on a large pool of drivers from different companies, meaning the odds of being chosen for a test at any given time are relatively low, especially if your company has a small number of drivers; essentially, your chances of being selected are diluted by the larger pool within the consortium.

What is the Return to Duty process?

It's a series of steps that an employee must complete to return to a safety-sensitive job after a drug or alcohol violation. The process includes evaluation, education, treatment, and testing.

What is the FMCSA Portal? What do I need to open one?

It’s an online platform that allows users, including carriers, brokers, and state officials, to access various safety data and information systems related to commercial vehicles with a single set of login credentials. What do I need to open one? You will need to request your USDOT Pin and create a Login.gov account.

What is the Clearinghouse? What do I need to open one?

It's a central repository to track CDL driver drug and alcohol test results and return-to-duty information. What do I need to open one ? You need a valid email address and to create a login.gov account. You can use your existing login.gov account if you already have one.

What is a Query?

Detailed information about any violations found in a driver's Clearinghouse record.

I drove zero miles this quarter, do I need to file an IFTA return?

Yes, you must file a separate return each calendar quarter for each fuel type indicated on your initial or renewal application even when no miles were accrued that quarter.

fleet insights

Why We Do What We Do

At National Fleet Services, we believe in more than just business - we believe in building the future of the trucking industry. Through our dedication to its growth and sustainability, we help motor carriers succedd today while paving the way for the opportunties of tomorrow.

"I can't recommend National Fleet Services enough! I had questions about obtaining our DOT number and Ana went above and beyond to make sure we were doing things correctly."

RACH HILL

Let's set the wheels in motion

We look forward to hearing from you!

Homepage Contact Form

We will get back to you as soon as possible.

Please try again later.